By Jesse Sevilla

Every CPG brand faces the same fundamental logistics question: where should products sit between manufacturing and retail delivery? The answer determines freight costs, delivery speed, inventory requirements, and ultimately whether brands meet retailer commitments or scramble to explain delays. Geography matters more than most brands initially recognize, particularly when retail concentration, consumer markets, and import patterns align in specific regions.

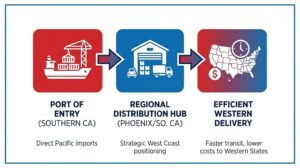

Southern California and Phoenix form a distribution corridor that serves unique advantages for food and beverage companies. The region combines port access for Asian imports, proximity to major retail distribution centers, and coverage of dense consumer markets across western states. Understanding these geographic dynamics helps brands make smarter decisions about 3PL partnerships and fulfillment infrastructure.

What You’ll Learn:

- How West Coast geography reduces transit times and freight costs for CPG distribution

- The role of port proximity in managing import logistics efficiently

- Why regional 3PL positioning outperforms national networks for many brands

- Five critical questions to ask when evaluating regional fulfillment partners

- How facility placement affects inventory requirements and cash flow

- What certifications and capabilities matter most in regional partnerships

Why Regional Positioning Drives CPG Efficiency

National 3PL networks sound appealing in theory. Facilities in multiple regions promise broad coverage and flexibility to shift inventory based on demand patterns. The reality proves more complicated for many CPG brands, particularly those importing through West Coast ports or serving concentrated retail accounts.

Consider a craft beverage company importing aluminum cans, glass bottles, and specialty ingredients through the Port of Long Beach. Those containers clear customs in Southern California. A national 3PL might route some inventory to a Midwest hub “for broader coverage,” adding cross-country freight, handling fees, and 5-7 transit days before products reach storage. Meanwhile, 60% of the brand’s retail accounts sit in California, Arizona, Nevada, and surrounding states within 2-day ground shipping of Southern California warehouses.

Regional positioning eliminates unnecessary movement. Products arrive at port, move directly to nearby food-grade warehousing facilities, and distribute efficiently to the markets that actually need them. The approach reduces costs, speeds delivery, and simplifies operations.

The Port of Los Angeles and Port of Long Beach together handle over 40% of containerized imports entering the United States, processing more than 17 million TEUs annually according to port authority data. For brands importing Asian products (ingredients, packaging materials, finished goods), Southern California provides the most direct path from arrival to storage. Every additional handling step and geographic transfer adds cost and delay.

The Phoenix Advantage for Southwest Distribution

Phoenix serves as a strategic distribution node for Southwest markets. Major retailers operate distribution centers throughout Arizona serving stores across multiple states. Beverage brands need cold storage access. Food companies require temperature-controlled facilities close to retail DCs. Confectionery products benefit from climate-controlled environments that prevent melting during summer months.

Phoenix warehouses offer several advantages beyond geography. Lower occupancy costs compared to coastal California markets make storage more economical. Proximity to Interstate 10, Interstate 17, and other major freight corridors enables efficient trucking throughout the Southwest. Access to regional transportation networks including both asset-based fleets and brokerage connections provides flexibility when volume fluctuates.

The regional approach concentrates inventory where demand exists rather than spreading it across facilities that may never serve nearby customers. Brands reduce safety stock requirements because they can replenish retail accounts quickly from nearby facilities. Lower inventory carrying costs improve cash flow and reduce the capital tied up in excess stock.

Five Questions to Ask When Choosing a Regional 3PL

1. What Certifications Does the Facility Actually Hold?

Food and beverage products require specific certifications. GMP (Good Manufacturing Practices), BRC (Brand Reputation through Compliance), and Organic certifications verify that facilities meet food safety and handling standards. These aren’t optional for products sold through major retailers. Many stores require proof of warehouse certifications before approving new suppliers.

Ask to see current certification documents for the specific facilities that will handle your products. National 3PLs might have certified facilities in some locations but not others. Regional specialists focused on food and beverage often maintain certifications across all their warehouses because that’s their core business.

2. How Integrated Are the Services You’ll Actually Need?

Most CPG brands need more than storage. Products require packaging, kitting, or labeling services for retail compliance. Promotional programs demand variety pack assembly. New products need flexibility to test different configurations. Transportation must connect storage with delivery.

Integrated service providers handle these functions under one roof within connected systems. Brands avoid moving products between separate vendors for packaging, then to another for storage, then coordinating pickup with a third-party carrier. Each handoff creates delay, handling risk, and coordination complexity. Regional 3PLs built around CPG needs typically offer integrated capabilities that national generalists cannot match economically.

3. Can They Adapt to Your Actual Operating Requirements?

Standard warehouse operations run Monday through Friday, 8am to 5pm. CPG reality often demands different schedules. Weekend packing projects to meet Monday retail deliveries. Overnight receiving to process containers that cleared customs late in the day. Flexible labor to handle promotional volume spikes.

Regional partners serving CPG companies build adaptability into their operating models. They staff accordingly and structure facilities to accommodate non-standard needs. National networks optimized for general logistics often lack this flexibility because their systems and labor models assume conventional schedules.

4. What Technology Platform Supports Operations and Visibility?

Real-time inventory visibility matters for demand planning, order commitments, and financial reporting. Integration between warehouse management systems and brand ERPs eliminates manual data entry and reconciliation errors. API connections enable automated order processing and shipment notifications.

Many 3PLs depend on third-party software vendors, limiting customization and slowing problem resolution. Regional specialists with on-site IT departments can build custom integrations, troubleshoot issues immediately, and adapt systems as brand needs evolve. States Logistics operates 13 facilities across Southern California and Phoenix with dedicated IT infrastructure supporting technology integration that keeps pace with CPG brand requirements.

5. Do Environmental Practices Align With Your Brand Values?

Sustainability commitments extend beyond product formulation into supply chain operations. Retailers increasingly require environmental compliance from suppliers and their logistics partners. Consumer brands face pressure to demonstrate reduced carbon footprints across operations.

Electric vehicle fleets, solar-powered facilities, and energy-efficient operations reflect genuine environmental commitment rather than marketing claims. Regional 3PLs can implement sustainable practices more consistently than national networks where each facility operates semi-independently under different management.

Cost Analysis: Regional vs. National 3PL Networks

Transportation typically represents the largest variable cost in CPG fulfillment. Full truckload rates average $1.85 to $2.25 per mile according to DAT Freight & Analytics data. Moving products from Los Angeles to a Midwest hub adds 1,800 miles ($3,330 to $4,050 per truck) before distribution to western state retailers even begins. Those products then travel back west for final delivery, adding redundant costs.

Regional positioning eliminates this inefficiency. Products stay in the geography where they’ll sell. A Southern California warehouse reaches Nevada, Arizona, and most of California with next-day ground shipping. Phoenix facilities serve Arizona, New Mexico, and portions of surrounding states equally fast. The freight savings compound across every shipment throughout the year.

Inventory carrying costs matter too. Financial models typically assign 20% to 30% annual carrying cost to inventory (capital cost, storage, insurance, obsolescence risk). Brands holding 45 days of inventory in a national network versus 30 days regionally save substantial capital. For a brand with $5 million annual inventory value, reducing holding by 15 days saves approximately $60,000 annually in carrying costs alone.

The CPG Specialization Factor

Companies with 67 years of CPG logistics experience understand operational nuances that matter for food and beverage fulfillment. Temperature requirements vary by product (wine storage differs from energy drinks differs from chocolate). Organic certifications demand segregated storage and documented handling procedures. Alcoholic beverage regulations require specific compliance in receiving, storage, and shipping.

Regional 3PLs focused on CPG develop this specialized expertise because it’s their primary business. Staff training, facility design, and operational procedures reflect deep category knowledge. National generalists handling automotive parts, consumer electronics, and apparel alongside food products inevitably compromise specialization for breadth.

Frequently Asked Questions

How does West Coast warehouse location reduce costs for CPG brands?

Proximity to the Port of Los Angeles and Port of Long Beach eliminates cross-country freight for Asian imports. Products move directly from port to warehouse, avoiding the $3,000 to $4,000 per truckload cost of shipping to distant hubs. Regional positioning also enables next-day ground shipping to major western markets, reducing expedited freight needs.

What makes Phoenix advantageous for CPG distribution?

Phoenix provides economical warehouse space with excellent highway access to Southwest retailers. The region offers temperature-controlled facilities for products requiring climate control, lower occupancy costs than coastal markets, and strategic positioning to serve Arizona, New Mexico, Nevada, and portions of surrounding states with fast ground delivery.

Do regional 3PLs have enough capacity for growing brands?

Quality regional 3PLs operate multiple facilities with scalable space. Southern California and Phoenix combined offer millions of square feet of available food-grade warehouse space. Brands can expand within their existing 3PL relationship rather than outgrowing partners and facing disruptive transitions.

How quickly can products move from port to warehouse to retail?

Containers clearing customs in the morning typically reach Southern California warehouses by afternoon. Products can be received, put away, and available for order fulfillment within 24 hours. Ground transit to major California retailers takes 1-2 days, Arizona 1-2 days, Nevada 2 days. Total port-to-retail often completes in 3-4 days.

What certifications should CPG brands require from regional warehouses?

Food products require GMP (Good Manufacturing Practices) certification at minimum. Products sold through major retailers typically need BRC (Brand Reputation through Compliance) as well. Organic products mandate USDA Organic handling certification. Verify the specific facilities handling your products hold current certifications, not just that the company has them somewhere.

Can regional 3PLs handle both warehousing and transportation needs?

Many regional specialists operate asset-based transportation alongside warehousing, or maintain strong brokerage networks for comprehensive coverage. Integrated providers coordinate receiving, storage, and delivery within connected systems, simplifying operations and improving delivery performance compared to coordinating separate warehouse and trucking vendors.

Making Geographic Strategy Work for Your Brand

Location decisions shape fulfillment costs, delivery performance, and inventory efficiency for years. Brands choosing regional 3PL partners positioned in their primary markets often achieve better results than those defaulting to national networks on the assumption that broader coverage equals better service.

The analysis comes down to understanding where products originate (import ports), where they sell (retail concentration), and what specialized capabilities they need (certifications, packaging, temperature control). For CPG brands serving western markets with products arriving through Pacific ports, Southern California and Phoenix provide the geographic, operational, and economic advantages that drive competitive fulfillment. Want clarity on where your products should live between port and retail? Connect with us to map it out.